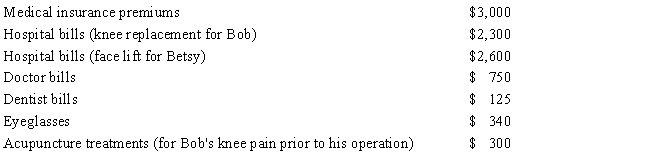

For 2014, Betsy and Bob, ages 62 and 68, respectively, are married taxpayers who file a joint tax return with AGI of $48,000. During the year they incurred the following expenses:

In addition, their insurance company reimbursed them $3,000 for the above expenses.

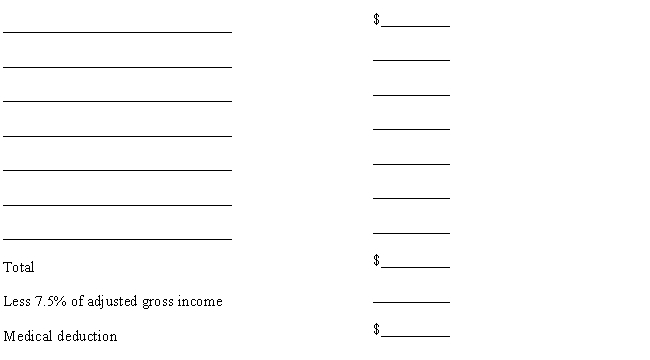

Using the format below, calculate Betsy and Bob's deduction for medical and dental expenses for 2014.

Correct Answer:

Verified

Q53: Jake developed serious health problems and had

Q90: Which of the following employees may deduct

Q91: Alicia is a single taxpayer with AGI

Q93: Pat has a dependent daughter and files

Q94: April and Wilson are married and file

Q97: During 2014, Sarah, age 29, had adjusted

Q98: Mary Lou took an $8,000 distribution from

Q99: For married taxpayers filing a joint return

Q100: Daniel lives in a state that charges

Q136: Which of the following is true with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents