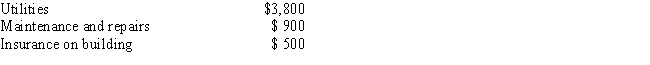

Bill is the owner of a house with two identical apartments. He resides in one apartment and rents the other apartment to a tenant. The tenant made timely monthly rental payments of $550 per month for the months of January through December, 2014. The following expenses were incurred on the entire building: In addition, depreciation allocable to the rented apartment is $1,500. What amount should Bill report as net rental income for 2014?

A) $0

B) $100 loss

C) $2,500

D) $3,250

E) None of the above

Correct Answer:

Verified

Q23: Nancy has active modified adjusted gross income

Q24: Patrick owns a home on the beach

Q25: Arnold purchased two rental properties 6 years

Q28: If a Section 401(k) plan allows an

Q30: Thelma works at a liquor store in

Q65: In order for a pension plan to

Q72: Under a defined contribution plan, the contribution

Q73: The expenses associated with the rental of

Q81: Norm is a real estate professional with

Q84: Ned has active modified adjusted gross income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents