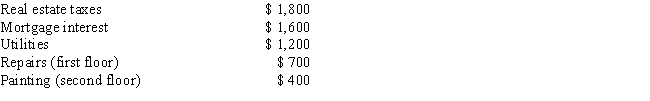

Donald owns a two-family home. He rents out the first floor and resides on the second floor. The following expenses attributable to the total building were incurred by Donald for the year ended December 31, 2014: In addition, the depreciation attributable to the entire building would be $2,000. What is the total amount of the expenses that Donald can deduct on Schedule E of Form 1040 (before any limitations) ?

A) $3,300

B) $3,850

C) $4,000

D) $4,200

E) None of the above

Correct Answer:

Verified

Q35: Lester rents his vacation home for 6

Q36: Choose the correct statement.Passive losses

A)May not be

Q36: Arnold purchased interests in two limited partnerships

Q37: Carey, a single taxpayer, purchased a rental

Q39: Warren invested in a limited partnership tax

Q42: Which of the following statements is correct?

A)Contributions

Q43: Choose the incorrect answer. Money removed from

Q44: Jody is a physician (not covered by

Q45: Donald, a 40-year-old married taxpayer, has a

Q72: Paul earns $55,000 during the current year.His

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents