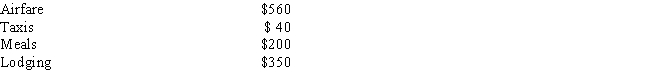

Barry is a self-employed attorney who travels to New York on a business trip during 2014. Barry's expenses were as follows: How much may Barry deduct as travel expenses for the trip?

A) $0

B) $950

C) $1,000

D) $1,050

E) None of the above

Correct Answer:

Verified

Q18: Janine is a sole proprietor owning a

Q27: Deductible transportation expenses:

A)Include meals and lodging.

B)Include only

Q27: Greg, a self-employed plumber, commutes from his

Q32: Stone Pine Corporation, a calendar year taxpayer,

Q34: Patricia is a business owner who is

Q77: There is a limitation of $25 per

Q89: Most taxpayers must use the specific charge-off

Q96: If a home office is used for

Q100: A deduction for a business bad debt

Q103: Net operating losses may be carried forward

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents