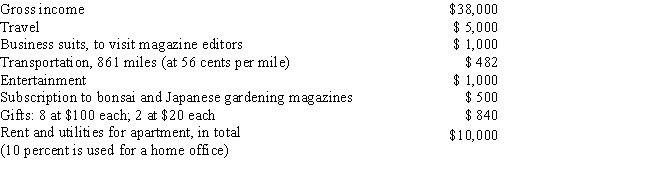

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year. His results of operations are as follows:

What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Correct Answer:

Verified

Q29: Taxpayers who make a combined business and

Q45: Choose the correct answer.

A)Education expenses are deductible

Q61: Peter is a self-employed attorney. He gives

Q63: Ellen loans Nicole $45,000 to start a

Q65: Patrick has a business net operating loss

Q67: In his spare time, Fred likes to

Q68: Splashy Fish Store allows qualified customers to

Q87: Tim loaned a friend $4,000 to buy

Q107: In determining whether an activity should be

Q109: Which of the following factors are considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents