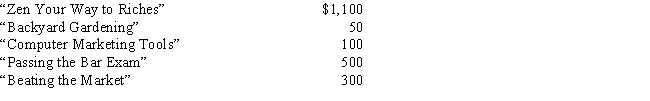

Michael has a very successful business as a financial consultant. Michael attends the following seminars:

How much can Michael deduct as business education expenses?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: Which of the following is not a

Q80: Karen has a net operating loss in

Q82: Bobby is an accountant who uses a

Q82: Chris opens a chiropractic office in Houston

Q83: Martin has a home office for his

Q83: Paul is a self-employed investment adviser who

Q84: Natasha is a self-employed private language tutor.

Q85: Rick is a business adviser who lives

Q86: Donald, a cash basis dentist, had $7,000

Q106: The net operating loss (NOL)provisions of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents