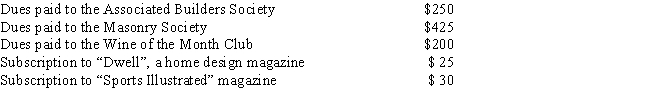

Paul is a general contractor. How much of the following expenses may Paul deduct?

Correct Answer:

Verified

The Wine of t...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: Christine is a self-employed tax accountant who

Q47: Ruth is a self-employed surgeon and is

Q61: Terry is a policeman employed by the

Q70: Carol, a CPA, is always required by

Q86: Donald, a cash basis dentist, had $7,000

Q89: David purchases a yacht solely for the

Q92: Mary is an insurance salesperson and a

Q93: Girard is a self-employed marketing consultant who

Q94: Curt is self-employed as a real estate

Q95: Sally and Martha are tax accountant partners

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents