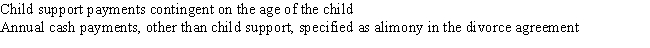

Laura and Leon were granted a divorce in 2005. In accordance with the decree, Leon made the following payments to Laura in 2014: How much should Laura include in her 2014 taxable income as alimony?

A) $0

B) $4,000

C) $6,000

D) $10,000

E) None of the above

Correct Answer:

Verified

Q17: Which of the following is nontaxable income

Q47: Roger is required under a 2004 divorce

Q48: In 2014, Uriah received the following interest

Q49: Which of the following gifts or prizes

Q50: Tim receives $500 of qualified dividends from

Q53: Mary received the following items during 2014:

Q53: Marie had a good year. She received

Q55: Seymore named his wife, Penelope, the beneficiary

Q56: Richard and Alice are divorced and under

Q57: Steve and Laura were divorced in 2008.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents