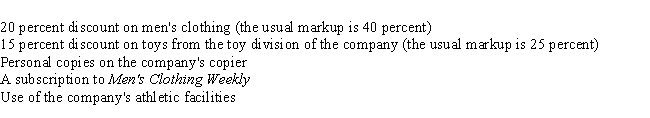

William, a single taxpayer, works for the men's clothing division of a large corporation. During 2014, William received the following fringe benefits:

As a result of receiving the above fringe benefits, what amount must William include in his 2014 gross income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Indicate whether each of the items listed

Q40: Indicate whether each of the items listed

Q81: Joey is a single taxpayer. Joey's employer

Q83: Marco and his family are covered by

Q99: Bob is a machinist in a remote

Q111: Jim, a single individual, was unemployed for

Q112: As a new benefit to employees, the

Q115: During 2014, Margaret and John received $24,000

Q116: Curt's tax client, Terry, is employed at

Q119: During the 2014 tax year, Thomas and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents