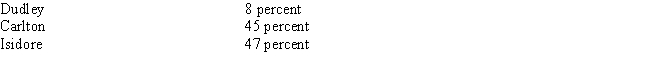

During 2013, Anita was entirely supported by her three sons, Dudley, Carlton, and Isidore, who provided support for her in the following percentages:  Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?

Which of the children may be allowed to claim his mother as a dependent, assuming a multiple support agreement exists?

A) Dudley

B) Dudley or Carlton

C) Carlton or Isidore

D) Dudley, Carlton, or Isidore

E) None of the above

Correct Answer:

Verified

Q12: Amended individual returns are filed on:

A)Form 1040X

B)Form

Q15: Depending on the amounts of income and

Q50: Eugene and Velma are married. For 2014,

Q52: Robert is a single taxpayer who has

Q53: During 2014, Howard maintained his home in

Q54: Alan, whose wife died in 2012, filed

Q56: John, 45 years old and unmarried, contributed

Q57: During 2014, Murray, who is 60 years

Q58: All of the following factors are important

Q80: An unmarried taxpayer who maintains a household

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents