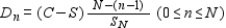

One of the methods that the Internal Revenue Service allows for computing depreciation of certain business property is the sum-of-the-years'-digits method. If a property valued at C dollars has an estimated useful life of N years and a salvage value of S dollars, then the amount of depreciation Dn allowed during the nth year is given by  where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,

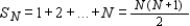

where SN is the sum of the first N positive integers representing the estimated useful life of the property. Thus,  If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

If office furniture worth $7,300 is to be depreciated by this method over N = 11 years and the salvage value of the furniture is $700, find the depreciation for the third year by computing D3 .

A) $2,700

B) $900

C) $700

D) $450

Correct Answer:

Verified

Q159: Five years ago, Diane secured a bank

Q160: The Sandersons are planning to refinance their

Q161: Find the first five, terms of the

Q162: Find the book value of office equipment

Q163: Find the sum of the odd integers

Q165: It has been projected that the population

Q166: Find the tenth term of the arithmetic

Q167: Find the sum of the first 13

Q168: Find the 50th term and sum of

Q169: Moderne Furniture Company had sales of $1,500,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents