Formulate but do not solve the problem.

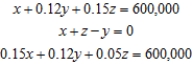

A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low risk. Management estimates that high-risk stocks will have a rate of return of 15%/year; medium-risk stocks, 12%/year; and low risk stocks, 5%/year. The members have decides that the investment in medium-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested) . Let x be the amount of money invested in high-risk stocks, y be the amount of money invested in medium-risk stocks, and z be the amount of money invested in low-risk stocks.

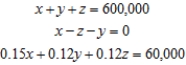

A)

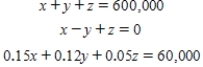

B)

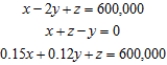

C)

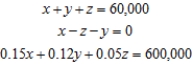

D)

E)

Correct Answer:

Verified

Q18: Solve the linear system of equations

Q19: Formulate but do not solve the problem.

Q20: Formulate but do not solve the problem.

Q21: Solve the linear system of equations. If

Q22: Formulate but do not solve the problem.

The

Q24: Determine whether the system of linear equations

Q25: Solve the linear system of equations. If

Q26: Solve the linear system of equations. If

Q27: Solve the linear system of equations. If

Q28: Solve the linear system of equations. If

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents