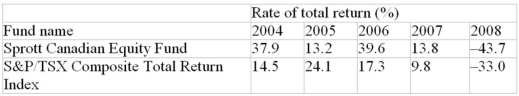

The following table presents the rates of total return in successive years from 2004 to 2008 for the Sprott Canadian Equity Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Correct Answer:

Verified

Q4: Albert Greco paid $1,974 for a $10,000

Q12: A six-year, $20,000 GIC has a maturity

Q18: Seven years before it matures the value

Q290: The following table presents the rates of

Q296: The S&P/TSX Composite Index rose 3.4%, dropped

Q321: The union representing the Stanford Marketing Services

Q328: Last year, the Muirs purchased a rental

Q329: After two consecutive years of 7% rates

Q330: An investor purchased preferred shares on the

Q331: In the last year, the market value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents