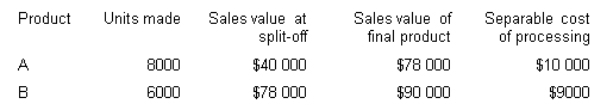

Lipex Pty c joint process.Each product may be sold at the split-off point or processed further.Additional processing requires no special facilities,and production costs of further processing are entirely variable and traceable to the products involved.Joint production costs for the year were $60 000.Sales values and costs are as follows.Allocate the joint production costs based on the physical units method.What are the joint costs assigned to product A?

A) $25 714

B) $20 339

C) $34 286

D) $30 000

Correct Answer:

Verified

Q50: Lipex Pty Ltd produces two products (A

Q52: A firm incurs manufacturing costs totalling $240

Q52: The joint cost allocation method that is

Q54: A firm incurs manufacturing costs totalling $240

Q54: A chocolate company uses the weight of

Q55: A joint product with very little value

Q56: Which of these statements about joint cost

Q56: Consider a situation where an activity-based costing

Q57: Consider the situation where an activity-based costing

Q60: The joint cost allocation method that recognises

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents