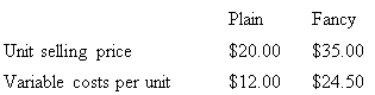

Maxie Pty Ltd makes and sells two types of shoes,Plain and Fancy.Product data is as follows:

Sixty per cent of the sales in units are Plain and annual fixed expenses are $45 000 and the sales mix remains constant.Assume an income tax rate of 20 per cent.The break-even point for this data is 5000 units in total.How will the calculation of the break-even point change (if at all) if the relative percentages of the products in the mix change from 60 per cent Plain shoes to 40 per cent Fancy shoes?

A) The break-even point in total will not change.The only change will be the relative number of each of the units.

B) Neither the break-even point in total nor the relative number of each of the units to produce at break-even will change.

C) The break-even point will change because the calculation above assumes a constant mix,namely 60 per cent to 40 per cent.

D) The break-even point will be higher.

Correct Answer:

Verified

Q6: If the contribution margin is $10, the

Q11: Suppose fixed expenses were to increase by

Q22: Maxie Pty Ltd makes and sells two

Q25: Econ Pty Ltd produced and sold 45

Q26: Which of the following assumptions is made

Q26: Maxie Pty Ltd makes and sells two

Q27: Econ Pty Ltd produced and sold 45

Q30: Cost volume profit analysis is based on

Q37: If the operating leverage factor is known,

Q40: The extent to which an organisation uses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents