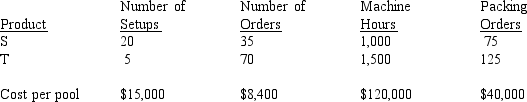

Tusker Corporation manufactures two products (S and T). The overhead costs have been divided into four cost pools that use the following activity drivers:

a. Compute the allocation rates for each of the activity drivers listed.

b. Allocate the overhead costs to Products S and T using activity-based costing.

c. Compute the overhead rate using machine hours under the functional-based costing system.

d. Allocate the overhead costs to Products S and T using the functional-based costing system overhead rate calculated in part (c).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q183: In a time-driven ABC system, once the

Q185: In the time-driven ABC systems, managers

A)assign resources

Q188: Green Mountain Manufacturing has recently installed an

Q188: Which of the following statements is TRUE?

A)A

Q189: Funland Manufacturing Company produces specially machined parts.

Q192: The Roanoke plant of the Virginia Company

Q193: Maroone, Inc., has identified the following overhead

Q194: Refer to Figure 4-22. What is the

Q196: Harrison Corporation produces specially machined parts. The

Q197: Which of the following is NOT an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents