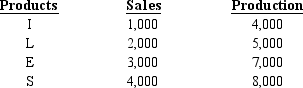

Impacto Corporation produces four products in a joint process for $650,000. The following information is available on total sales and production in units:  What amount of joint costs will be allocated to I based on the physical units method?

What amount of joint costs will be allocated to I based on the physical units method?

A) $100,000

B) $650,000

C) $108,355

D) $300,000

Correct Answer:

Verified

Q14: Joint costs are

A)separable.

B)allocated on the basis of

Q18: The cost of crude oil used in

Q30: Which joint cost allocation method is described

Q111: The split-off point can best be defined

Q133: Hibernation Company incurred $500,000 to manufacture the

Q136: Joint costs are allocated because of

A) financial

Q138: Cumadin Corporation, which manufactures products W, X,

Q140: Suppose that a sawmill processes logs into

Q141: Suppose that a Plywood manufacturer processes wood

Q160: Algonquin Products produces two products, X and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents