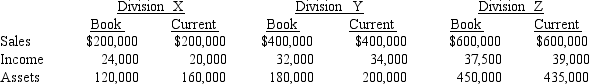

O'Malley Company requires a return on capital of 15 percent. The following information is available for 2016:

Required:

Required:

a. Compute return on investment using both book and current values for each division. (Round answer to three decimal places.)

b. Compute residual income for both book and current values for each division.

c. Does book value or current value provide the better basis for performance evaluation?

d. Which division do you consider the most successful?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: What problems do owners face in encouraging

Q119: In the Bombadier Company, Division A has

Q120: The Chasis Division provides frames for the

Q122: Benjamin Manufacturing Company has two divisions, X

Q123: The Hampton Division of Long Island Company

Q126: Worldwide Inc., is a multinational company with

Q127: The Uniforms Division of Baseball Company has

Q128: Nantucket Company has two divisions that report

Q129: Sporadic Company has the following data for

Q131: Worldwide Inc., is a multinational company with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents