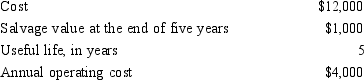

Missoula Office Services is considering the purchase of a new server to replace the one in operation. Data on the new server are as follows:

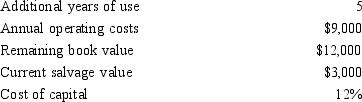

If the existing server is kept and used, it would require the purchase of additional hardware a year from now

If the existing server is kept and used, it would require the purchase of additional hardware a year from now

costing $2,000. After the use of the server for five years, the salvage value would be $300. Additional information on the existing system is as follows:

The company uses the straight-line method of depreciation with no mid-year convention.

The company uses the straight-line method of depreciation with no mid-year convention.

Required:

Should the new server be purchased? Why or why not?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Under the current tax law, an asset

Q110: Bodacious Company is considering the purchase of

Q115: Colorform Company is considering the purchase of

Q116: A corporation with taxable income of $400,000

Q119: What are the differences that affect capital

Q119: Information about a project Wunderbar Company is

Q120: Vendome Company is considering the purchase of

Q121: Local Construction Company is considering the purchase

Q122: Marion Dexter Company is evaluating a proposal

Q125: Santander Company is considering a project that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents