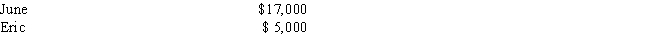

Oliver has two employees who earned the following amounts during 2017: If Oliver timely pays 5.4 percent for state unemployment tax,what is the amount of his 2017 FUTA after the state tax credit?

A) $0

B) $72

C) $112

D) $176

E) None of the above

Correct Answer:

Verified

Q42: A credit against the FUTA tax is

Q45: Provide answers to the following questions:

a. What

Q45: Which of the following statements is true

Q47: The FUTA tax is paid by:

A)Employees only.

B)Employers

Q56: Which of the following items may be

Q62: Emily is a self-employed attorney.

a.

Assuming that Emily

Q63: The Wash Your Paws Self-Service Dog Wash,

Q64: The FUTA tax for 2017 is based

Q66: George has four employees who earned $75,000,$27,000,$2,100,and

Q68: Lucinda is a self-employed veterinarian in 2017.Her

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents