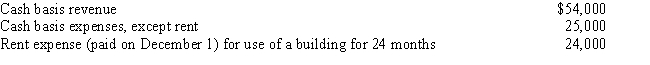

Becky is a cash basis taxpayer with the following transactions during her calendar tax year: What is the amount of Becky's taxable income from her business for this tax year?

A) $7,000 loss

B) $11,000

C) $27,500

D) $28,000

E) None of the above

Correct Answer:

Verified

Q4: Annualizing" is a method by which the

Q6: Most partnerships, S corporations, and personal service

Q7: All S corporations must use the accrual

Q13: Which of the following is not an

Q16: The Dot Corporation has changed its year-end

Q16: Generally,cash basis taxpayers must account for payments

Q17: Quince Corporation changes its year-end from a

Q18: In general, accrual basis taxpayers recognize income

Q19: From the records of Tom,a cash basis

Q61: If a corporation has a short tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents