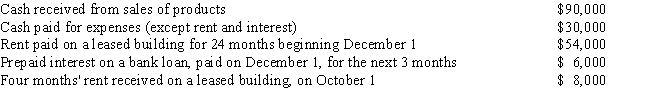

Polly is a cash basis taxpayer with the following transactions during the year:

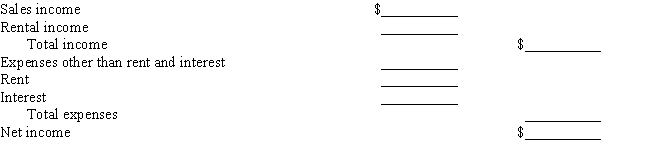

Calculate Polly's income from her business for this calendar year.

Correct Answer:

Verified

Q1: If land declines in value, it may

Q4: In applying the statutory depreciation percentages from

Q5: To be depreciated, must an asset actually

Q9: Which of the following statements with respect

Q10: Expenditures incurred to maintain an asset in

Q16: If an asset's actual useful life is

Q18: If a taxpayer purchases land worth $200,000

Q20: Under MACRS, the same method of depreciation

Q34: Cork Oak Corporation purchased a heavy-duty truck

Q42: An asset is placed in service on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents