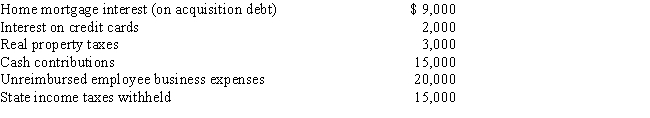

Dan and Maureen file a joint income tax return for 2017.They have two dependent children,ages 7 and 9.Together they earn wages of $152,000.They also receive taxable interest income of $8,000 and interest on City of Los Angeles bonds of $12,000.During 2017,they received a state income tax refund of $3,000 relating to their 2016 state income tax return on which they itemized deductions.Their expenses for the year consist of the following:

Calculate Dan and Maureen's tentative minimum tax liability assuming an AMT exemption amount of $84,500,before any phase-outs.Show your calculations.

Correct Answer:

Verified

Q44: List at least two AMT preferences and/or

Q59: Jasmine is a single marketing manager with

Q60: Household income for purpose of the individual

Q61: John and Susan file a joint income

Q62: In the case of the adoption of

Q63: For all taxpayers,except those married filing separately,the

Q66: In 2017,Brady purchases a 2017 Nissan Leaf

Q67: The total expenses that can be taken

Q68: Taxpayers are allowed two tax breaks for

Q69: Carla and Bob finalized an adoption in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents