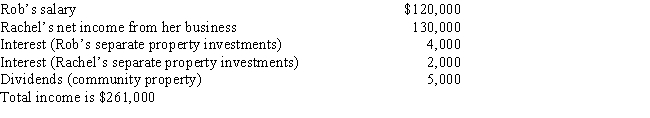

Rachel and Rob are married and living together in California.Their income is:

a.If Rachel files a separate return,how much income should she report?

b.If Rob and Rachel live in Texas,what should Rachel report as income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q32: Net unearned income of certain minor children

Q99: Glen and Mary have two children,Chad,age 12,and

Q100: Salary earned by minors may be taxed

Q127: New York is a community property state.

Q143: Which one of the following conditions must

Q143: Which of the following is not a

Q146: Most states are community property states.

Q148: Molly and Steve are married and live

Q150: Patricia and Cliff are married but file

Q151: Lee and Pat are married taxpayers living

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents