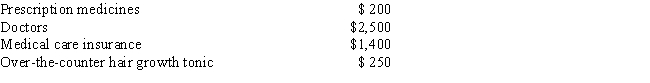

In 2017,David,age 65,had adjusted gross income of $32,000.During the year he paid the following medical expenses:  What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2017?

What amount can David deduct as medical expenses (after the adjusted gross income limitation) in calculating his itemized deductions for 2017?

A) $0

B) $900

C) $1,700

D) $4,100

E) None of the above

Correct Answer:

Verified

Q14: The 2017 standard mileage rate for taxpayer

Q17: Jon,age 45,had adjusted gross income of $26,000

Q21: During the current year,George,a salaried taxpayer,paid the

Q22: During the current year,Mr.and Mrs.West paid the

Q24: The cost of a fishing license is

Q42: The amount of a special assessment charged

Q45: Which of the following is not deductible

Q51: If real property is sold during the

Q56: The cost of over-the-counter aspirin and decongestants

Q58: Which of the following is not considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents