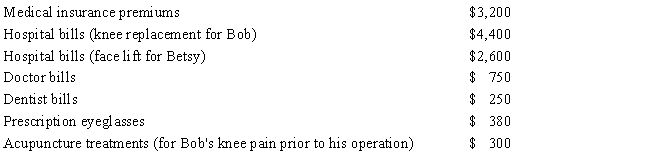

For 2017,Betsy and Bob,ages 62 and 68,respectively,are married taxpayers who file a joint tax return with AGI of $50,000.During the year they incurred the following expenses:

In addition,their insurance company reimbursed them $3,100 for the above expenses.

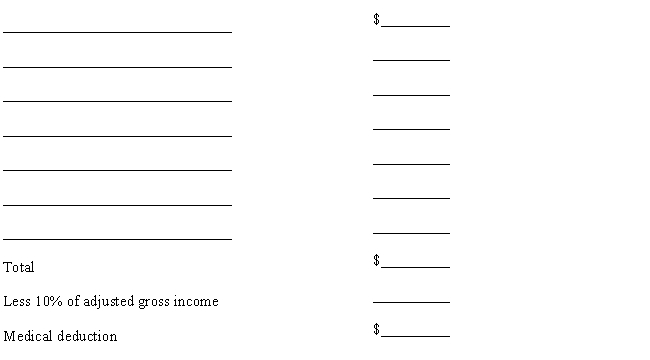

Using the format below,calculate Betsy and Bob's deduction for medical and dental expenses for 2017.

Correct Answer:

Verified

Q5: During 2017,Sarah,age 29,had adjusted gross income of

Q6: Randy is advised by his physician to

Q10: Glenda heard from a friend that prescriptions

Q11: Roberto,age 50,has AGI of $110,000 for 2017.He

Q12: The adjusted gross income (AGI)limitation on medical

Q13: During the current year,Mary paid the following

Q14: The 2017 standard mileage rate for taxpayer

Q45: The cost of a chiropractor's services qualifies

Q59: If a taxpayer installs special equipment in

Q60: Lodging for a trip associated with medical

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents