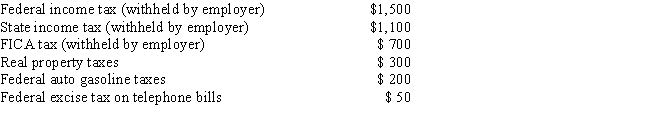

During the current year,George,a salaried taxpayer,paid the following taxes which were not incurred in connection with a trade or business: What amount can George claim for the current year as an itemized deduction for the taxes paid,assuming he deducts state and local income taxes?

A) $1,100

B) $1,150

C) $1,400

D) $2,000

E) None of the above

Correct Answer:

Verified

Q17: Jon,age 45,had adjusted gross income of $26,000

Q19: In 2017,David,age 65,had adjusted gross income of

Q22: During the current year,Mr.and Mrs.West paid the

Q24: The cost of a fishing license is

Q42: The amount of a special assessment charged

Q45: Which of the following is not deductible

Q51: If real property is sold during the

Q58: Which of the following is not considered

Q62: Which of the following taxes is not

Q65: Which one of the following is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents