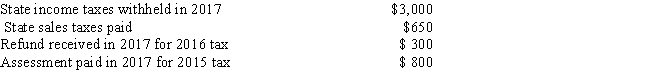

Weber resides in a state that imposes a tax on income.The following information relating to Weber's state income taxes is available: What amount should Weber use as state and local income taxes in calculating itemized deductions for his 2017 Federal income tax return?

A) $2,700

B) $3,000

C) $3,500

D) $3,800

E) None of the above

Correct Answer:

Verified

Q35: Margo has $2,200 withheld from her wages

Q38: Frank is a resident of a state

Q39: Sherry had $5,600 withheld from her wages

Q45: Which of the following interest expense amounts

Q63: Daniel lives in a state that charges

Q75: Taxpayers are permitted an itemized deduction for

Q84: The interest paid on a loan used

Q91: Charu is charged $70 by the state

Q92: What is the maximum amount of home

Q96: Which of the following is not deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents