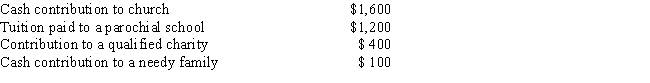

For 2017,Eugene and Linda had adjusted gross income of $30,000.Additional information for 2017 is as follows: What is the maximum amount they can deduct for charitable contributions in 2017?

A) $500

B) $1,600

C) $1,700

D) $2,000

E) None of the above

Correct Answer:

Verified

Q64: Douglas and Dena paid the following amounts

Q65: Stewart had adjusted gross income of $22,000

Q70: Gwen has written acknowledgments for each of

Q71: Richie Rominey purchases a new $4.3 million

Q83: Sally and Jim purchased their personal residence

Q88: Andy borrows $20,000 to invest in bonds.

Q109: Individual taxpayers may carry forward indefinitely charitable

Q115: Taxpayers must itemize their deductions to be

Q117: If a taxpayer contributes a painting to

Q121: During the current year, Hom donates a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents