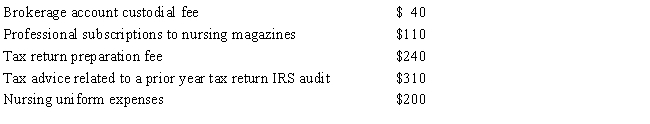

During the current tax year,Ruth,a nurse at Dr.Pan's office,incurred the following expenses:

If Ruth's adjusted gross income is $29,000,calculate her net miscellaneous deductions after the adjusted gross income percentage limitation.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: If a ballet dancer seeks work as

Q104: Expenses of education to improve or maintain

Q105: Catherine is a CPA employed by a

Q106: Peter is a plumber employed by a

Q107: If an employee receives a reimbursement for

Q109: Unreimbursed employee business expenses are miscellaneous itemized

Q110: Educational expenses are deductible as a miscellaneous

Q111: Which of the following miscellaneous deductions are

Q112: An accountable expense reimbursement plan:

A)Requires the employee

Q113: Jean's employer has an accountable plan for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents