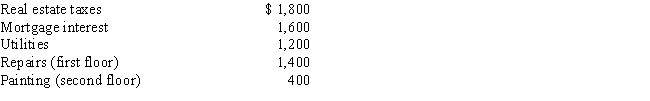

Donald owns a two-family home.He rents out the first floor and resides on the second floor.The following expenses attributable to the total building were incurred by Donald for the year ended December 31,2017: In addition,the depreciation attributable to the entire building would be $2,000.What is the total amount of the expenses that Donald can deduct on Schedule E of Form 1040 (before any limitations) ?

A) $3,300

B) $3,850

C) $4,000

D) $4,700

E) None of the above

Correct Answer:

Verified

Q14: Lester rents his vacation home for 6

Q64: Regardless of a taxpayer's involvement in the

Q65: In most cases, an individual taxpayer reports

Q66: Walt and Jackie rent out their residence

Q68: Dividend income is considered "passive income."

Q71: Net losses on the rental of vacation

Q75: Passive losses are fully deductible as long

Q76: Selma owns a beach cottage that she

Q78: Under the passive loss rules, real estate

Q84: Ned has active modified adjusted gross income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents