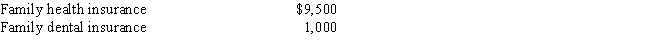

Mike and Rose are married and file jointly.Mike earns $45,000 from wages and Rose reports $450 on her Schedule C as an artist.Since Mike's work does not offer health insurance,Rose pays the following health insurance premiums from her business account:

How much can Mike and Rose deduct as self-employed health insurance?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Ellen supports her family as a self-employed

Q9: Which of the following is true about

Q16: Which of the following statements is true

Q23: What percentage of medical insurance payments can

Q26: Warren invested in a limited partnership tax

Q30: Arnold purchased interests in two limited partnerships

Q68: Dividend income is considered "passive income."

Q75: Passive losses are fully deductible as long

Q84: Ned has active modified adjusted gross income

Q91: Nancy has active modified adjusted gross income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents