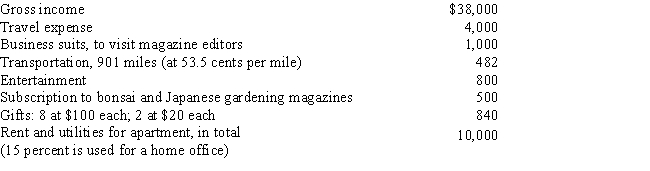

Lew started a business writing a popular syndicated Japanese gardening column in the current year and will report a profit for his first year.His results of operations are as follows:

What is the net income Lew should show on his Schedule C? Show the calculation of his taxable income.

Correct Answer:

Verified

Q2: Generally, for an activity to be treated

Q6: Brandi operates a small business and employs

Q7: Peter is a self-employed attorney.He gives the

Q9: Patricia is a business owner who is

Q9: A taxpayer who adopts the LIFO method

Q11: What is the purpose of Schedule C?

Q12: When a taxpayer uses the FIFO inventory

Q13: Which of the following is not a

Q15: The taxpayer must use either the FIFO

Q18: Janine is a sole proprietor owning a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents