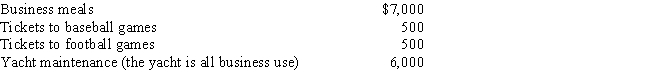

Girard is a self-employed marketing consultant who spends significant time entertaining potential customers.He keeps all the appropriate records to substantiate his entertainment.He has the following business-related expenses in the current year.

What is the tax deductible entertainment expense Girard may claim in the current year.On which tax form should he claim the deduction?

What is the tax deductible entertainment expense Girard may claim in the current year.On which tax form should he claim the deduction?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Taxpayers who make a combined business and

Q41: Mikey is a self-employed computer game software

Q45: Choose the correct answer.

A)Education expenses are deductible

Q47: Ruth is a self-employed surgeon and is

Q52: Choose the correct statement:

A)If a taxpayer does

Q52: Which of the following items incurred while

Q54: Sally and Martha are tax accountant partners

Q60: Linda is self-employed and spends $600 for

Q63: Natasha is a self-employed private language tutor.In

Q74: Teachers at the kindergarten through high school

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents