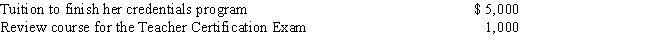

Natasha is a self-employed private language tutor.In 2017,she obtained her teaching credentials,hoping to receive a job as a seventh grade public school English teacher.She had the following education expenses for the year:

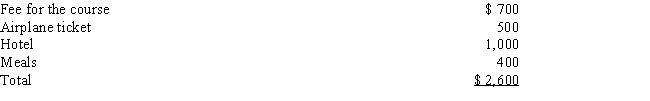

Natasha also attended a seminar in Washington,D.C. ,titled "The Motivated Student." Her expenses for the trip are as follows:

Determine how much of the above expenses are deductible on her Schedule C.

Determine how much of the above expenses are deductible on her Schedule C.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q45: Choose the correct answer.

A)Education expenses are deductible

Q47: Ruth is a self-employed surgeon and is

Q54: The expense of travel as a form

Q58: Girard is a self-employed marketing consultant who

Q60: Linda is self-employed and spends $600 for

Q61: Terry is a policeman employed by the

Q62: To be deductible as the cost of

Q65: Michael has a very successful business as

Q72: A business gift with a value of

Q74: Teachers at the kindergarten through high school

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents