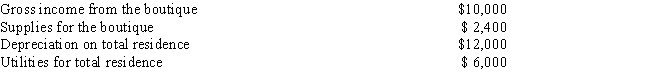

Richard operates a hair styling boutique out of his home.The boutique occupies 420 of the home's 1,200 square feet of floor space.Other information is as follows: What amount of income or loss from the boutique should Richard show on his return?

A) $0 income or loss

B) $10,400 loss

C) $3,500 income

D) $1,300 income

E) None of the above

Correct Answer:

Verified

Q81: Splashy Fish Store allows qualified customers to

Q83: Martin has a home office for his

Q87: Tim loaned a friend $4,000 to buy

Q89: Most taxpayers must use the specific charge-off

Q92: Gene is a self-employed taxpayer working from

Q93: Peter operates a dental office in his

Q94: Hope Springs,a teacher,loaned Hugh Owens,a friend,$10,000 to

Q95: Kendra is a self-employed taxpayer working exclusively

Q96: If a home office is used for

Q98: Sherri is a tax accountant. She prepared

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents