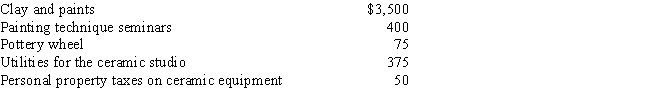

Katie operates a ceramics studio from her garage.She incurs the following expenses:

Katie's gross receipts from her business were $2,000.

a.If the studio is deemed to be a hobby,then calculate the amount of expenses Katie may deduct,and describe how she may report the income and expenses on her tax return.

b.If the studio is not a hobby,then calculate the amount of expenses Katie may deduct,and describe how she may report the income and expenses on her tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q106: Which of the following is not a

Q107: In determining whether an activity should be

Q107: Keri is a single taxpayer and has

Q108: Patrick has a business net operating loss

Q109: Karen has a net operating loss in

Q109: Which of the following factors are considered

Q110: Dennis is a self-employed hair stylist who

Q113: In his spare time,Fred likes to restore

Q114: Jess has had a couple of good

Q115: Karen was ill for most of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents