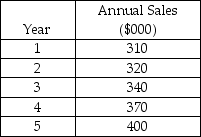

Table 6.4

Mr.Lee is considering a capacity expansion for his supermarket.The annual sales projected for the next five years follow.The current capacity is equivalent to $300,000 sales.Assume a 20 percent pretax profit margin.

-Using the information in Table 6.4,if Lee expands the capacity to an equivalent of $360,000 sales now (year 0) ,and then expands the capacity to an equivalent of $400,000 sales at the beginning of year 4,how much would pretax cash flow increase in total for all years (years 1 through 5) ?

A) less than $30,000

B) more than $30,000 but less than $40,000

C) more than $40,000 but less than $50,000

D) more than $50,000

Correct Answer:

Verified

Q68: Table 6.6

Burdell Labs is a diagnostic laboratory

Q69: The Northern Manufacturing Company is producing products

Q70: Innovative Inc.is experiencing a boom for the

Q71: Sleep Tight Motel has the opportunity to

Q72: A company's production facility,consisting of two identical

Q74: Table 6.3

The North Bend Manufacturing Company is

Q75: John Owen owns a drugstore that is

Q76: George P.Burdell owns a hot tub store

Q77: Table 6.5

The T.H.King Company has introduced a

Q78: Table 6.5

The T.H.King Company has introduced a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents