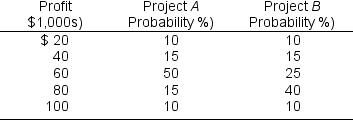

A firm is considering two projects,A and B,with the following probability distributions for profit.  Given the above,the expected value of project A in $1,000s) is

Given the above,the expected value of project A in $1,000s) is

A) $60

B) $65

C) $70

D) $75

E) $80

Correct Answer:

Verified

Q1: In the maximin strategy,a manager choosing between

Q4: Refer to the following probability distribution for

Q6: A firm is considering two projects,A and

Q7: a manager can list all outcomes and

Q10: Refer to the following probability distribution for

Q10: A probability distribution

A)is a way of dealing

Q11: Choosing the decision with the maximum possible

Q12: exists when

A)all possible outcomes are known but

Q14: In the maximax strategy a manager choosing

Q14: making decisions under risk

A)maximizing expected value is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents