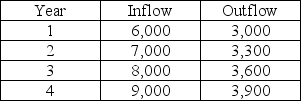

Lisa is pondering the construction and operation of a home-based cattery.She expects it will cost $35,000 to construct and will have a lifespan of four years before it collapses due to faulty construction and ammonia rot.Cash flows during those four glorious years are estimated as follows:  If the interest rate is 5%,what is the present value of the cattery project?

If the interest rate is 5%,what is the present value of the cattery project?

A) -18,800

B) -20,790

C) -26,378

D) -47,168

Correct Answer:

Verified

Q22: Acapella University offers to lock-in a student's

Q28: Which of the following is an accelerated

Q32: Which method of analysis does not consider

Q33: Lisa is pondering the construction and operation

Q35: The NCX10 now features a coffee brewing

Q35: Depreciation is not a legitimate cash flow.

Q37: Straight-line depreciation is an accelerated depreciation method.

Q40: The net present value (NPV) method evaluates

Q44: The _ is used to evaluate projects

Q47: _ is an allowance for the consumption

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents