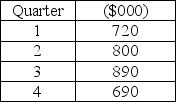

George P.Burdell owns a hot tub store that is experiencing significant growth.Burdell is trying to decide whether to expand the store's capacity,which currently is at $750,000 in sales per quarter.He is thinking about expanding to the $850,000 level.The before-tax profit from additional sales is 20 percent.Sales are seasonal,with peaks in the spring and summer quarters.Forecasts of capacity requirements,expressed in ($000) sales per quarter,for next year (year 2) are:  Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Burdell is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

Demand in year 3 and beyond is expected to exceed $850,000 per quarter.Burdell is considering expansion at the end of the fourth quarter of this year (year 1) .How much would before-tax profits in year 2 increase because of this expansion?

A) less than $28,000

B) more than $28,000 but less than $32,000

C) more than $32,000 but less than $36,000

D) more than $36,000

Correct Answer:

Verified

Q46: What is a capacity cushion? Provide examples

Q52: As the desired capacity cushion increases, the

Q59: What factors should be considered when selecting

Q59: Which one of the following statements about

Q67: Table 4.1

The Union Manufacturing Company is producing

Q69: The single milling machine at Stout Manufacturing

Q71: When a firm makes a long-term capacity

Q73: The lock box department at Bank 21

Q77: A well-educated operations manager used the capacity

Q80: A standard work year is 2,000 hours

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents