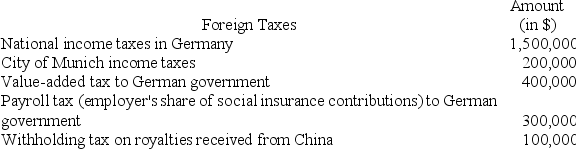

Rainier Corporation, a U.S. corporation, manufactures and sells quidgets in the United States and Europe. Rainier conducts its operations in Europe through a German GmbH, which the company elects to treat as a branch for U.S. tax purposes. Rainier also licenses the rights to manufacture quidgets to an unrelated company in China. During the current year, Rainier paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

What amount of creditable foreign taxes does Rainier incur?

What amount of creditable foreign taxes does Rainier incur?

Correct Answer:

Verified

The creditable inco...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Which of the following statements best describes

Q70: Which of the following persons should not

Q74: Boomerang Corporation, a New Zealand corporation, is

Q82: Rafael is a citizen of Spain and

Q83: Spartan Corporation, a U.S. company, manufactures widgets

Q84: Polka Corporation is a 100 percent owned

Q85: Portland Corporation is a U.S. corporation engaged

Q88: Ypsi Corporation has a precredit U.S. tax

Q89: Boca Corporation, a U.S. corporation, received a

Q99: Cheyenne Corporation is a U.S. corporation engaged

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents