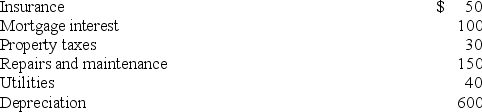

Kristen rented out her home for 10 days during the year for $5,000. She used the home for personal purposes for the other 355 days. She allocated the following home expenses to the rental use of the home:

Kristen's AGI is $120,000 before considering the effect of the rental activity. What is Kristen's AGI after considering the tax effect of the rental use of her home?

Kristen's AGI is $120,000 before considering the effect of the rental activity. What is Kristen's AGI after considering the tax effect of the rental use of her home?

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Which of the following statements regarding limitations

Q97: Which of the following statements regarding the

Q98: Alison Jacobs (single) purchased a home in

Q99: Several years ago, Chara acquired a home

Q100: Jasper is looking to purchase a new

Q102: Alfredo is self-employed and he uses a

Q103: Careen owns a condominium near Newport Beach

Q104: Ashton owns a condominium near San Diego,

Q105: Tyson owns a condominium near Laguna Beach,

Q123: Mercury is self-employed and she uses a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents