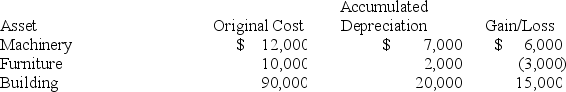

Suzanne, an individual, began business four years ago and has never sold a §1231 asset. Suzanne owned each of the assets for several years. In the current year, Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Explain whether the sale of a machine

Q82: Sadie sold 10 shares of stock to

Q84: Sandra sold some equipment for $10,000 in

Q85: Manassas purchased a computer several years ago

Q93: Which of the following may qualify as

Q95: Which of the following is not true

Q103: Frederique sold furniture that she uses in

Q106: Alexandra sold equipment that she uses in

Q109: Brandy sold a rental house that she

Q111: Sunshine LLC sold furniture for $75,000. Sunshine

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents