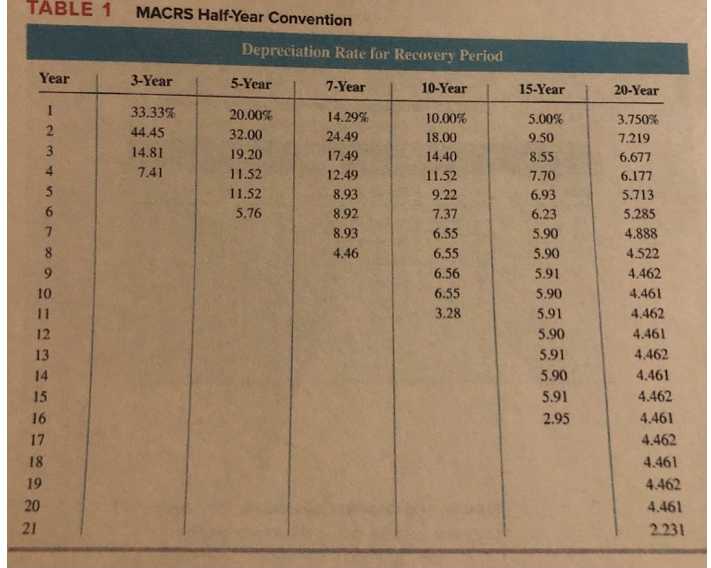

-Littman LLC placed in service on July 29,2018 machinery and equipment (7-year property) with a basis of $600,000.Littman's income for the current year before any depreciation expense was $100,000.Which of the following statements is true to maximize Littman's total depreciation expense for 2018? (Use MACRS Table 1)

A) Littman should take §179 expense equal to the maximum $1,000,000.

B) Littman should take no §179 expense.

C) Littman's §179 expense will be greater than $100,000.

D) Littman's §179 expense will be less than $100,000.

E) None of the choices are correct.

Correct Answer:

Verified

Q62: Assume that Bethany acquires a competitor's assets

Q63: Lenter LLC placed in service on April

Q66: Racine started a new business in the

Q67: Which of the following assets are eligible

Q68: Daschle LLC completed some research and development

Q72: Billie Bob purchased a used camera (5-year

Q73: Taylor LLC purchased an automobile for $55,000

Q74: Potomac LLC purchased an automobile for $30,000

Q77: Jasmine started a new business in the

Q77: Which of the following assets is not

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents