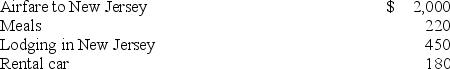

Shelley is employed in Texas and recently attended a two-day business conference at the request of her employer. Shelley spent the entire time at the conference and documented her expenditures (described below) . What amount can Shelley deduct if she is not reimbursed by her employer?

A) $2,850

B) $2,740

C) $1,850 if Shelley's AGI is $50,000

D) All of these expenses are deductible if Shelley attends a conference in Texas.

E) None of the expenses are deductible by an employee.

Correct Answer:

Verified

Q46: When does the all-events test under the

Q48: Bill operates a proprietorship using the cash

Q49: Clyde operates a sole proprietorship using the

Q50: Ronald is a cash method taxpayer who

Q52: Which of the following types of transactions

Q55: Which of the following is a true

Q55: Colbert operates a catering service on the

Q60: Adjusted taxable income is defined as follows

Q72: Beth operates a plumbing firm. In August

Q74: Jim operates his business on the accrual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents