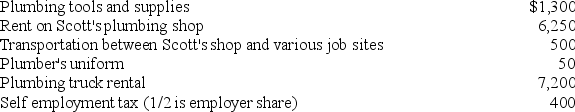

Scott is a self-employed plumber and his wife, Emily, is a full-time employee for the University. Emily has health insurance from a qualified plan provided by the University, but Scott has chosen to purchase his own health insurance rather than participate in Emily's plan. Besides paying $5,400 for his health insurance premiums, Scott also pays the following expenses associated with his plumbing business:

What is the amount of deductions for AGI that Scott can claim this year (2018)?

What is the amount of deductions for AGI that Scott can claim this year (2018)?

Correct Answer:

Verified

$15,500 = $1,300 + $6,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Which of the following is a true

Q62: Glenn is an accountant who races stock

Q67: Rachel is an accountant who practices as

Q72: Which of the following is a true

Q75: Frieda is 67 years old and deaf.

Q76: Kaylee is a self-employed investment counselor who

Q76: When taxpayers donate cash and capital gain

Q78: Larry recorded the following donations this year:

Q79: Which of the following is a true

Q82: Detmer is a successful doctor who earned

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents