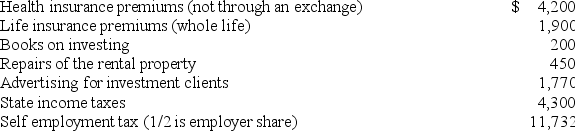

Kaylee is a self-employed investment counselor who also owns a rental property. This year, she collected $85,000 in fees and paid the following expenses:

Kaylee files single. Calculate her adjusted gross income.

Kaylee files single. Calculate her adjusted gross income.

Correct Answer:

Verified

The books on...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Which of the following is a true

Q62: Glenn is an accountant who races stock

Q67: Rachel is an accountant who practices as

Q72: Which of the following is a true

Q75: Frieda is 67 years old and deaf.

Q76: When taxpayers donate cash and capital gain

Q77: Scott is a self-employed plumber and his

Q78: Larry recorded the following donations this year:

Q79: Which of the following is a true

Q98: Tita,a married taxpayer filing joint,has a $700,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents