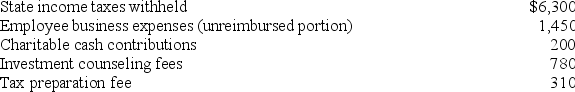

Toshiomi works as a sales representative and travels extensively for his employer's business. This year Toshiomi was paid $75,000 in salary and made the following expenditures:

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single.

Toshiomi also made a number of trips to Las Vegas for gambling. This year Toshiomi won $12,000 in a poker tournament and this amount was almost enough to offset his other gambling losses ($13,420). Calculate Toshiomi's taxable income if he files single.

Correct Answer:

Verified

$68,500 = ($75,000 salary + $12,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q62: Glenn is an accountant who races stock

Q66: Rachel is an accountant who practices as

Q67: Rachel is an accountant who practices as

Q82: Detmer is a successful doctor who earned

Q83: This year, Benjamin Hassell paid $20,000 of

Q84: Misti purchased a residence this year. Misti,

Q86: Erika (age 62) was hospitalized with injuries

Q88: Jenna (age 50) files single and reports

Q111: This year Kelly bought a new auto

Q112: Jon and Holly are married and live

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents