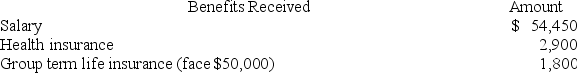

Frank received the following benefits from his employer this year. What amount must Frank include in his gross income?

A) $54,450

B) $57,350

C) $56,250

D) $59,150

E) Zero - these benefits are excluded in gross income.

Correct Answer:

Verified

Q69: Emily is a cash basis taxpayer,and she

Q79: Harold receives a life annuity from his

Q79: Fran purchased an annuity that provides $12,000

Q83: This year, Fred and Wilma, married filing

Q84: Shaun is a student who has received

Q114: Bernie is a former executive who is

Q116: Ethan competed in the annual Austin Marathon

Q119: Bart,a single taxpayer,has recently retired.This year,he received

Q120: Karl works at Moe's grocery.This year Karl

Q121: NeNe is an accountant and U.S.citizen,who has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents